Municipal Taxes, Budgets, Bids & Requests For Proposals (RFPs)

The Municipal budget constitutes the legal authorization to levy taxes and spend public funds. Municipal Budgets control the financial operations of the municipality. Local government manages its operations by conforming to the revenue and appropriations budget for that year. Please note: The Borough of Englishtown has no statutory authority to veto or approve any school-related taxes. Previous municipal Budgets can be viewed by clicking the links below.

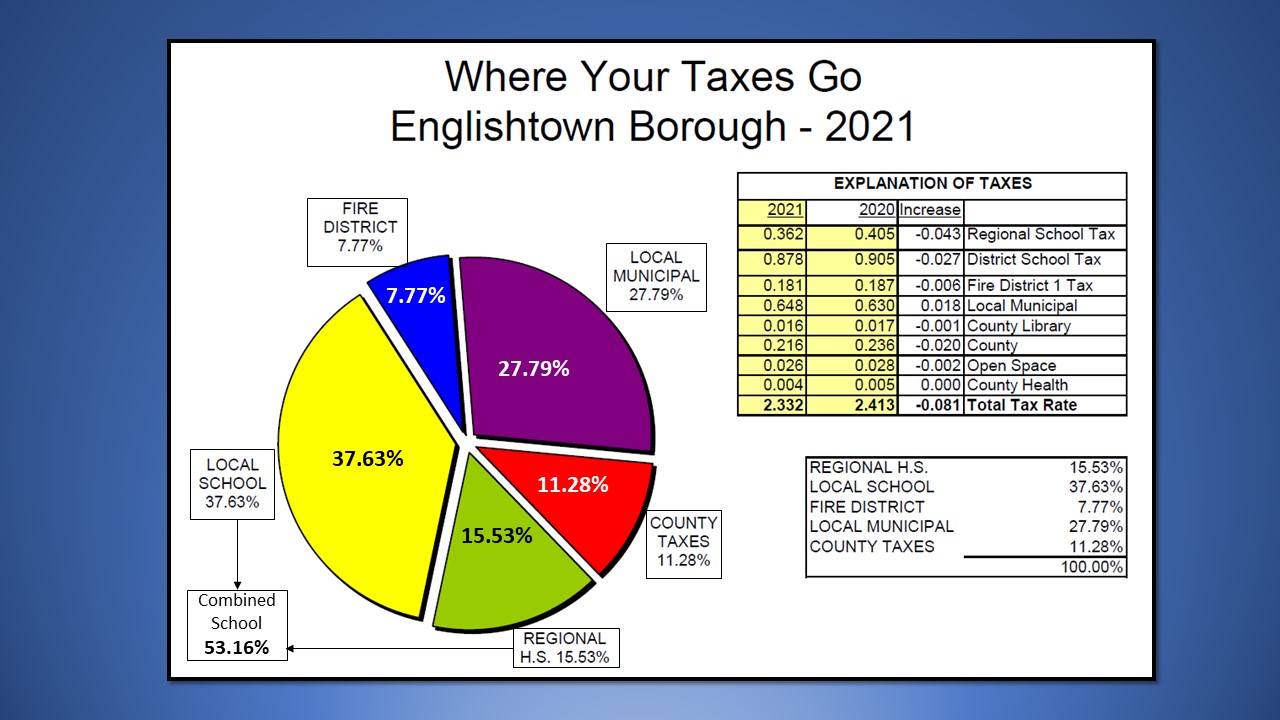

WHERE DO MY TAXES GO?

Click the link below to see a breakdown of your Municipal Taxes:

Explanation of Taxes (Link to NJ Division of Taxation)

Monmouth County Board of Taxation (Link to Monmouth County)

2022 Property Tax Information:

If you received your ‘NOTICE OF PROPERTY TAX ASSESSMENT FOR 2022″

If you agree with the assessed value shown, you do not need to do anything. If you disagree with the assessed value shown, you may file an appeal with the Monmouth County Board of Taxation.

Forms, instructions and a guide to the process Understanding Property Assessment Appeals for Monmouth County may be obtained at https://secure.njappealonline.com or through your municipal assessor at the address printed on the reverse of this notice.

Assessment appeals filed with the Monmouth County Board of Taxation must be filed on or before January 15, 2022 or 45 days from the date mailed. as it appears on the front of this notice, whichever date Is later.

Also, note that the Monmouth County Board of Taxation has developed an online appeal system accessed via https://secure.njappealonline.com. Traditional “paper” appeals are also available at your municipal assessor’s office: Englishtown Borough Hall, 15 Main St., Englishtown, NJ 07726.

If the assessed value exceeds $1,000,000, you have the option of filing your appeal directly with the Tax Court at PO BOX 972, Hughes Justice Complex, Trenton, New Jersey 08625. Pursuant to N.J.S.A. 54:3-21(a)(2), all assessment appeals filed directly to the Tax Court must be filed on or before April 1, 2022 or 45 days from the date mailed as it appears on this assessment notice. whichever date is later.

Forms which you may use to file your complaint may be found at https://www.njcourts.gov/courts/tax.html?lang=eng.

This assessment will be used to calculate your property tax bill. Do not multiply last year’s property tax rate by the current year’s assessment value to determine taxes for the current year.

Bids & Requests For Proposals (RFPs):

The following Bids and RFPs are currently open. Please click on the links to download and view the documents. For questions, please call the Finance Department: 732-446-9235 Option 7

* Recycling Bid Specifications: The Borough of Englishtown is soliciting bid proposals from solid waste collectors interested in providing curbside and bulk collection and disposal of commingled recyclables commencing on January 1, 2022, with alternates and options to extend the Contract an additional four years, in accordance with the terms of these Bid Specifications and N.J.A.C. §7:26H–6, et seq.

* Solid Waste Bid Specifications: The Borough of Englishtown is soliciting bid proposals from solid waste collectors interested in providing solid waste collection and disposal services commencing on January 1, 2022, with alternates and options to extend the Contract an additional four years, in accordance with the terms of these Bid Specifications and N.J.A.C. §7:26H–6, et seq.

Municipal Budgets:

AFS / ADS / AUDIT

(See All AFS/ADS At Bottom Of Page)

2022 Annual Financial Statement (AFS)

2021 Annual Financial Statement (AFS)

2021 Annual Debt Statement (ADS)

2020 Annual Financial Statement (AFS)

2020 Annual Debt Statement (ADS)

2019 Audit

Municipal Audit

The State of New Jersey requires an annual audit to be performed by a Registered Municipal Accountant (RMA) pursuant to N.J.S.A. 40A:5-4. The purpose of the audit is to review and give an opinion on the financial statements of the municipality.

Municipal Annual Financial Statement (AFS)

The Annual Financial Statement is the Unaudited Financial Reports of the municipality as of December 31st.

Municipal Annual Debt Statement (ADS)

The Annual Debt Statement is a true statement of the debt condition of the municipality as of December 31st and is computed as provided by the Local Bond Law of New Jersey

- 2013 Audit

- 2014 Audit

- 2015 Audit

- 2016 Audit

- 2017 Audit

- 2018 Audit

- 2019 Audit

- 2020 Audit

- 2021 Audit (Year Has Not Closed)

PLEASE NOTE 2021 AUDIT, ANNUAL FINANCIAL STATEMENT, AND ANNUAL DEBT STATEMENT IS NOT AVAILABLE UNTIL THE YEAR CLOSES OUT.

Should you need a copy or request to see prior year Municipal Financial Documents please

contact the Municipal Clerk @ 732-446-9235 or email clerk@englishtownnj.com

(PLEASE PUT “FINANCIAL DOCUMENTS” IN SUBJECT LINE)